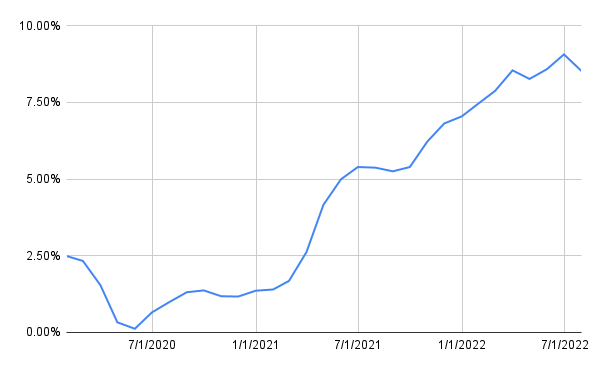

The chart above shows the trend in the rate of inflation for the U.S.

I hope you had a great holiday weekend! Among the various stories in the news about the return of college football and record heat, there were a few stories about the economy. As an economist, I have a lot of thoughts on the economy, here are a few.

Inflation – You may have heard that the financial markets are reacting to the impending raising of interest rates by the Federal Reserve Board. This is a necessary and painful antidote to the rampant inflation. Inflation is caused by too many dollars chasing too few goods, including the unwise dumping of trillions of dollars into the economy by the federal government. I hope you are paying attention. Inflation is real, and it is not good. Not only does it hurt consumers who have to pay more goods and services but whose wages aren’t rising as fast as the things they buy, but it is just plan bad for the economy in general, restricting growth and innovation.

Policies For Economic Prosperity – When it comes to economic policy, I believe in the power of incentives. If you tax productivity, productivity will decline. If you want economic growth and prosperity, you have to give individuals the freedom to pursue their ideas and reap the rewards of their efforts. Economic development, innovation, and growth are all accelerated when taxes are low, regulations are light, and government is minimized. This means keeping state government small so that the required tax burden on our citizens is also small. That might mean that some really popular programs have their funding cut or do not get funded at all. But in the long run, it will allow more people to become self-reliant and stay free from government dependence, reducing the need for those really popular programs. Policies that interfere with incentives by picking winners and losers circumvent the power of the market and are harmful to the economy in the long run.

Deregulating Workers – I am a champion for allowing workers to do jobs that they are trained to do without unnecessary government interference. Licensing should be limited to protecting the public’s health, safety and financial welfare. Too often, licensing has been used to protect people in a current profession from competition that comes from new entrants. These restrictions prevent people from getting to work, build up student debt, and contribute to worker shortages in critical occupations, such as mental health professionals or educators.

Cutting Taxes – Utah is one of only twelve states that continue to tax Social Security benefits. I used to think that wasn’t a big deal until I got looking into it. This is a clear case of double taxation. The income that goes into the system is taxed, then when you get your benefits, they are taxed too. This isn’t right. Recently, we exempted some lower income recipients from taxed benefits, but there are thousands of Utahns that are still paying tax on their benefits. I am introducing a proposal this year to end that.

Bravo – we agree with your succinct analysis entirely!! More power to you and thank you for being our Representative🙏🏻